What is the one thing which has been gaining momentum and considerable attention from regulators, policy makers and academicians in India especially, in the past two decades due to economic growth and business failure? Is this something that corporates really need to look upon or just another attempt demanding for even more regulations?

Running companies is difficult & making them successful is even more difficult which sometimes led to disastrous decisions & this is when the saviour comes into the picture which helps companies to make sound decisions to smoothly run their operations which eventually led to success.

Corporate Governance refers to the systems, principles, and processes by which companies are directed and controlled. Think of it as a set of principles and practices that ensure a company is run well, ethically, and in the best interest of everyone involved.

But do corporates really mean it as their saviour or just ignoring for a fact that it is an another regulation that they need to follow. Even when directors are able & experienced, boards sometimes still make poor decisions or are far too late in spotting problems & hence promoting a bad corporate governance.

Bad corporate governance could cripple even the best businesses. Let’s bring this to life with a practical example.

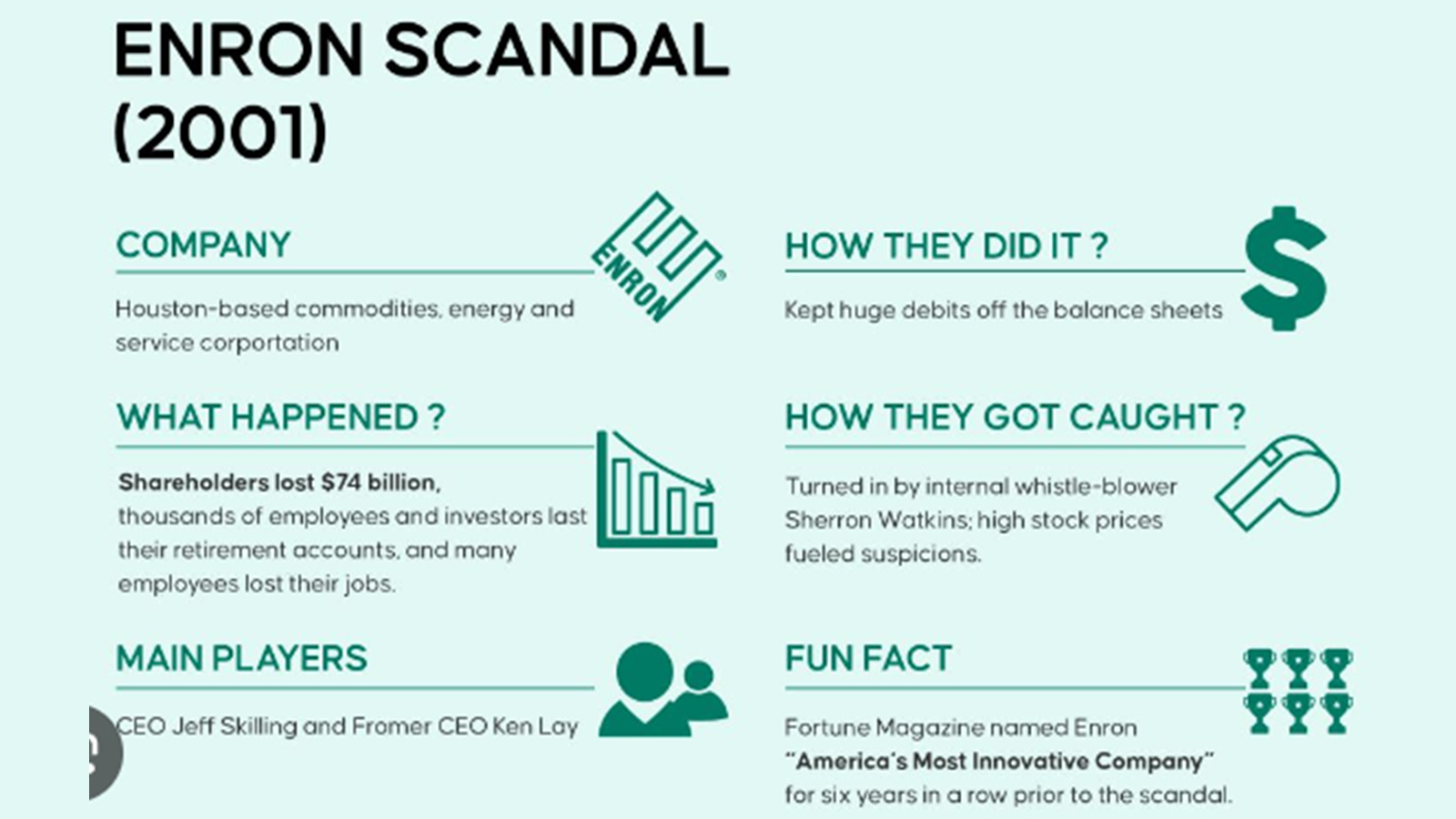

Case Study : Enron Corporation

Background:

Enron Corporation, once a leading energy company in the United States, became synonymous with corporate scandal and fraud. In the early 2000s, Enron's downfall was attributed to egregious lapses in corporate governance, which included fraudulent accounting practices and misleading financial reporting.

Issues:

1. Accounting Fraud: Enron used complex accounting techniques and off-balance-sheet entities to hide debt and inflate profits. This misleading financial reporting created an illusion of financial health.

2. Lack of Oversight: The company’s board of directors failed to provide adequate oversight and challenge the management's financial practices. They were complicit or negligent in their duties.

Impact:

1. Financial Collapse: Enron’s stock price plummeted, leading to bankruptcy in December 2001. The collapse resulted in massive financial losses for shareholders and employees.

2. Regulatory Reforms: The scandal prompted the enactment of the Sarbanes-Oxley Act of 2002, aimed at improving financial transparency and accountability in U.S. corporations.

Lesson Learned:

The Enron case underscores the importance of transparent financial reporting, rigorous internal controls, and an active, independent board of directors to prevent fraud and ensure accountability.

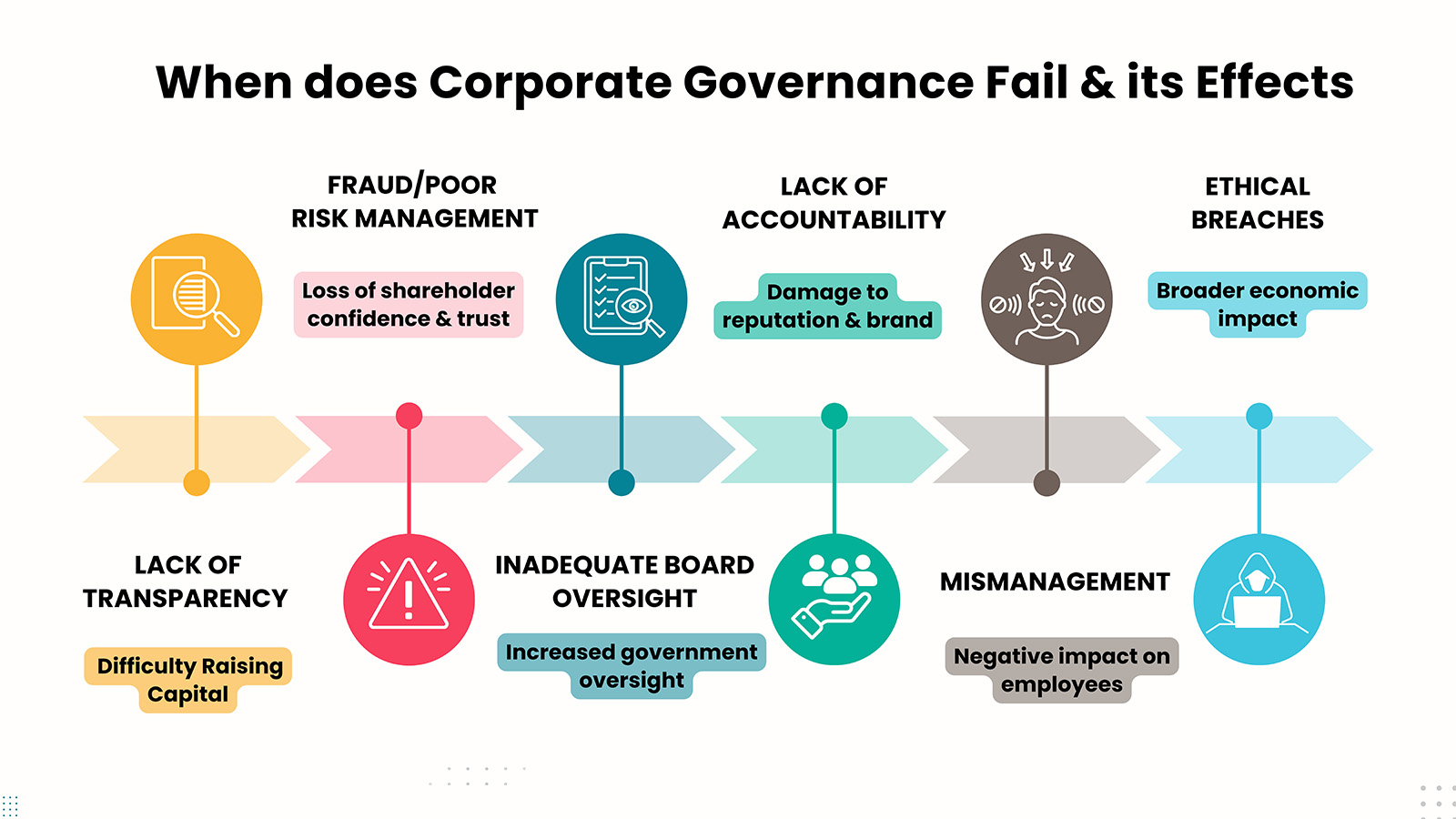

The case study of Enron illustrate the far-reaching impact of poor corporate governance. Issues such as financial mismanagement, lack of regulatory compliance, ethical breaches, and inadequate oversight can lead to significant financial losses, reputational damage, and legal consequences.

What’s the solution then? – Effective Corporate Governance!

Effective corporate governance demands rigorous financial accuracy, ethical behavior, comprehensive compliance programs, and vigilant oversight by the board of directors. It is essential for ensuring that a company operates with integrity, transparency, and accountability. These practices not only enhance corporate reputation but also contribute to the overall health and stability of the organization, benefiting shareholders and other stakeholders alike. Businesses need to ensure they remain disciplined, transparent, independent, accountable for their actions which could help them to stay away from controversies.